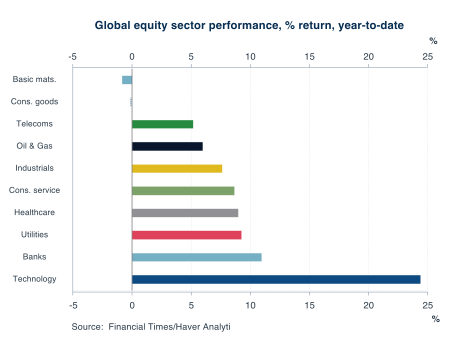

Global equity markets have generally been buoyant this year. Their sector-specific performance, moreover, chimes with the notion that global growth is moderating, but not slumping. Cyclically-sensitive sectors such as basic materials and consumer goods have certainly underperformed, while defensive sectors like utilities, healthcare, and consumer services have outperformed (see chart 6 below). The biggest and most notable outperformer, however, has been the technology sector, despite its cyclical sensitivity. That, in turn, underscores the importance of that sector’s secular drivers, including the advance of Artificial Intelligence.

Leave a comment