A Fed easing narrative has been re-energized over the past few days largely thanks to a slightly weaker than expected US CPI report last Wednesday but, more generally, because of a battery of weaker-than-expected US data over the past couple of weeks. It is noteworthy yet again on the inflation front how a negative US surprise has coincided with weaker global energy prices in recent weeks. Looking more broadly at the US outlook though it’s been notable as well to observe the reversal of fortune in the US and indeed the world economy in recent weeks.

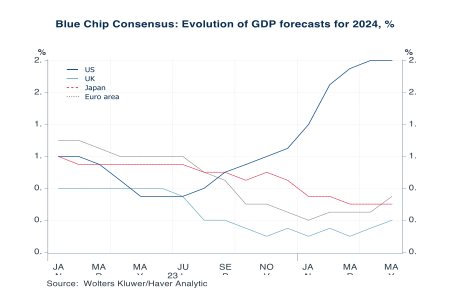

There are a couple of exhibits in the latest Charts of the Week publication from Haver Analytics (https://haverproducts.com/charts-of-the-week/) that chime with this showing, for instance, some subtle shifts in forecasters growth expectations for the US in the year ahead compared with other major economies.

Last week’s US retail sales data and some weak confidence data additionally suggest some of the shine has been coming off the US consumer. And this comes too as most of the underlying capacity gauges of the US economy, particularly those that concern the manufacturing sector, continue to suggest that dis-inflationary pressures ought to persist in the period immediately ahead.

More broadly at the global level this is noteworthy too because weaker than expected growth momentum in the US is now coinciding with stronger than expected growth momentum in Europe. That’s certainly the message from observing consensus growth forecasts for the latter and the decent GDP growth that was chalked up by many of its economies in Q1.

Chart: Stable US growth vs firmer EU growth expectations

Leave a comment